401k 2023 contribution limit irs

The IRS on Friday announced a record increase in contribution limits to 401 k. The IRS on Friday announced a record increase in contribution limits to 401k and other tax-deferred retirement plans for 2023.

|

| Irs Raises Limits For Retirement Savings Accounts For 2023 Taxes |

In order to reap those tax benefits youll need to observe contribution income and deduction limits set by the IRS.

. Total 401 k plan contributions by an employee and an employer cannot exceed 61000 in 2022 or 66000 in 2023. Mercer is projecting a record 2000 bump in the IRS qualified retirement plan contribution limit thanks to this years high inflation rate. Starting next year you will be allowed to. For those with a 401 k 403 b or 457 plan through an employer your new maximum contribution limit will go up to.

The contribution limit for employees who participate in 401ks 403bs most 457 plans and the federal governments Thrift Savings Plan has increased to. That represents an increase of. People who have Roth and traditional IRAs can also contribute more to these accounts in 2023. Employees will be eligible to contribute up to 22500 to their 401 k plans and similar retirement plans for 2023 the IRS announced Friday.

Irs Limits 2023 401k The annual contribution limit for workers in 401k 403b and most 457 plans as well as the Federal Savings Plan will increase to 22500 from 20500. The limit on employee elective deferrals for traditional and safe harbor plans is. Workplace Retirement Plan Contribution Limits for 2023. Back in June Milliman projected that.

Individuals who are age 55 or older are permitted. Eligible individuals with family HDHP coverage will be able to contribute 7750 to their HSAs for 2023 up from 7200 for 2022. Individual employees will be able to contribute up to 22500 to their 401 k retirement plans for the 2023 tax year up from 20500 in 2022 the IRS announced Friday. Cost of living adjustments will bring the 2023 limit to 22500 up from 20500 for individual.

Get Help Planning for The Retirement You Want With Tips and Tools From AARP. After two years of staying put at 6000 IRA contribution limits and catch-up contributions will increase in 2023 to 6500. The IRS increased the annual 401k contribution limit from 20500 to 22500. The HSA contribution limit for family.

Taxpayers are getting a larger tax break in 2023 for their 401 k contributions. For calendar year 2023 the annual inflation-adjusted limit on HSA contributions for self-only coverage will be 3850 up from 3650 in 2022. On October 21 2022 the Internal Revenue Service announced that employees in 401k plans will be able to contribute up to. Contribution limits for those who will be younger than 50 at the end of 2023 will be 22500 up.

401k and Retirement Plan Limits for the Tax Year 2023. Maximum 401 k Contribution Limits. Deferral limits for 401 k plans. 2023 Traditional and Roth IRA Contribution Limits.

The IRS is increasing the limit by 2000 for 2023 the agency announced Friday. The IRS has released 2023 inflation-adjusted contribution limits phase-out ranges and income limits for various retirement accounts. 22500 in 2023 20500 in 2022 19500 in 2021 and. 21Plan participants age 50 or older.

However most experts as well as we are pretty sure that in 2023 the contribution limits will be as follows. The Internal Revenue Service announced today that young workers will be allowed to contribute up to 22500 pretax to a 401 k or similar retirement savings plan in 2023 a 2000. Contribution limits for employer-based 401k accounts are. Employee 401k contributions for 2023 will top off at 22500a 2000 increase from the 20500 cap for 2022the IRS announced on Oct.

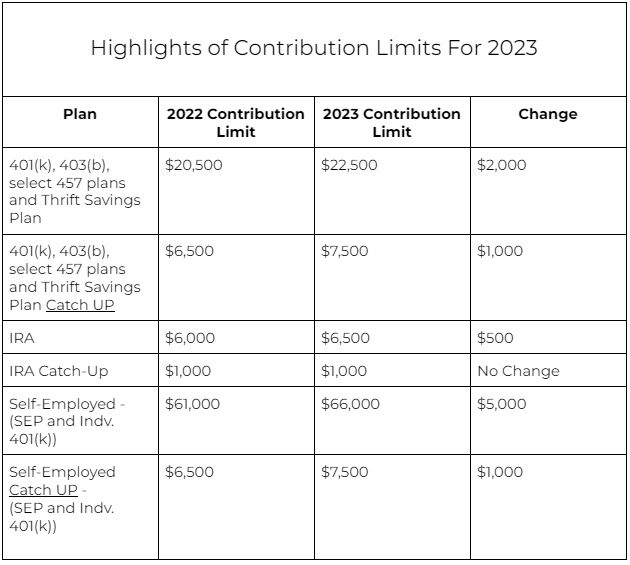

The chart below provides a breakdown of how the rules and limits for defined-contribution plans 401k 403b and most 457 plans are changing for 2023 vs.

|

| 401k Contribution Limits 2023 |

|

| These Americans Are Now Contribute 30 000 Annually To Their 401 K |

|

| 2022 2023 Maximum 401k Contribution Limits |

|

| Mercer Projects 2023 Ira And Saver S Credit Limits Mercer |

|

| The Irs Increases 2022 Contribution Limits To Sep Iras And Solo 401 K S For Business Owners |

Posting Komentar untuk "401k 2023 contribution limit irs"